Analysis of the Development Prospect of Power Battery Industry

In recent years, the new energy automobile market has developed rapidly, and the power battery industry has complemented each other, showing increasingly fierce competition. According to relevant forecasts, by 2020, the global sales of new energy vehicles will be 13 million, and China will reach 3.56 million.

As the core component of electric vehicle, the cost of power battery accounts for more than 40% of the total cost of electric vehicle. The development of electric vehicles also promotes the development of power batteries. It is estimated that the total domestic demand for power batteries will be about 90 GWh in 2020 and 310 GWh by 2025.

Statistics and Forecast of Power Battery Demand in China from 2016 to 2020

Data Source: Prospective Industry Research Institute

Statistical Analysis of China's Power Battery Industry Production in 2017

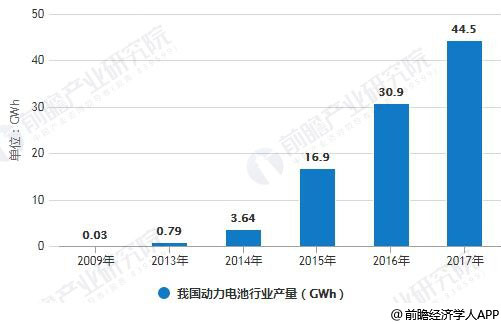

In recent years, the output of power battery industry in China has developed rapidly. According to the statistical data of "China Power Battery PACK Industry Development Prospect Forecast and Investment Strategic Planning Analysis Report" issued by Prospective Industry Research Institute, the output of China's power battery industry in 2009 was only 0.03GWh. In 2014, China's power battery industry output reached 3.64GWh. By 2016, the output of China's power battery industry exceeded 30GWh, and by 2017, the output of China's power battery industry reached 44.5GWh.

Statistics of China's Power Battery Industry Production from 2009 to 2017

Data Source: Prospective Industry Research Institute

Statistical Analysis of China's Power Battery Market Output Scale in 2017

In 2009, the output value of China's power battery market was about 126 million yuan. In 2014, the output value of China's power battery market approached 10 billion yuan. By 2015, China's power battery market output value reached 33.8 billion yuan. By 2017, the output value of China's power battery market has reached 72.5 billion yuan.

Statistical Situation of China's Power Battery Market Output Value Scale from 2009 to 2017

Data Source: Prospective Industry Research Institute

Development Forecast of China Power Battery Market in 2018

In 2017, China's new energy vehicle (EV + PHEV) power battery installed total electricity is about 36.24 GWh, compared with the 2016 28GWh data, an increase of about 29.4% year-on-year. In 2017, the top 10 enterprises in power battery installed capacity are Ningde Times, BYD, Waterma, Guoxuan Gaoke, Bike Power, Funeng, Lishen, Guoneng, Yiwei Lithium Energy and Zhihang. It is estimated that by 2024, the output of power batteries in China will reach 194.9 GWh and the output value of power batteries will reach 136.82 billion yuan.

Forecast of China's Power Battery Market Development in 2018-2024

Data Source: Prospective Industry Research Institute

China's Power Battery Market in 2018

Namely: Ningde Times and BYD are the two core companies, followed by Hefei Guoxuan, Shanghai Jiexin and Funeng Technologies. The top ten enterprises have more than 80% market share. It is worth mentioning that the market share of Ningde era has been further improved. The installed capacity of Ningde era is more than that of the second BYD and the third country Xuan Gaoke. BYD has steadily made progress, and its share is gradually increasing.

In terms of battery types, Ningde Age as the representative of battery enterprises, in 2018, lithium-ion batteries accounted for 83% of the total installed capacity, and this month accounted for 81%. BYD's lithium iron phosphate production has reached 40% since 2018, reflecting the demand for buses. In May, BYD made a big turnaround, with lithium iron phosphate as its main contribution. BYD passenger cars performed better in October.

Analysis of Three Major Problems in Power Battery Industry

1. The price of raw materials has risen sharply. As an industrial product sensitive to the price of raw materials, the cost of power batteries has increased in recent years due to the upstream cobalt price. In the past 2017, the cobalt price has doubled, from 270,000 yuan/ton at the end of 2016 to 534,000 yuan/ton at the end of 2017, and once reached 800,000 yuan/ton in the first quarter of this year. Even though power battery manufacturers have relatively high production capacity, they also have to suffer from the decline in gross margin.

On the other hand, the pricing of power batteries will also be under pressure. It is said that car companies will further reduce their purchasing costs next year, which will further reduce the profit margin of power battery manufacturers.

2. The subsidy policy is coming to an end

Everything has two sides. The state's new energy automobile subsidy policy is the key to the rapid rise of China's new energy automobile industry. In the past, the huge policy subsidies and the huge automobile market have made the capacity and efficiency of China's power battery manufacturers expand rapidly, leaving Japan, Korea and other enterprises behind in one fell swoop.

However, in recent years, our government's subsidy policy continues to decline, and even plans to completely cancel the subsidy policy for electric vehicles after 2020, which will greatly reduce the profit margin of power battery manufacturers. For example, a fast-charging electric bus with more than 10 meters can get a subsidy of 460,000 yuan in 2016. By 2017, the subsidy will be reduced to 200,000 yuan, and by 2018, only 130,000 yuan will be left.

3. Short Board of Industry Chain

It is undeniable that China's power battery industry has made great progress and achieved brilliant results, and the development of technology is equally undeniable. However, compared with multinational enterprises such as Korea and Japan and advanced science and technology, the performance, quality and cost of battery products are still difficult to meet the popularization needs of new energy vehicles, especially in the areas of basic key materials, system integration technology, manufacturing equipment and technology. There is still a big gap between China and the advanced international level. The short board of the industrial chain will restrict the development of power batteries in China in the medium and long term.

Previous:Development Trend Analysis of Lead-acid Battery Industry in China

Next:Already the last article